The world of cryptocurrency trading can be exciting and potentially lucrative for beginners. As digital currencies like Bitcoin and Ethereum gain more mainstream acceptance, many people are looking to get started in this relatively new form of investment. Before diving into the complex landscape of crypto trading, it’s crucial to gain a solid understanding of the foundational concepts, strategies, and risks associated with this digital asset class.

Cryptocurrency trading involves buying and selling digital assets, with the goal of profiting from price fluctuations. For beginners, it’s essential to become familiar with the unique characteristics and features of cryptocurrencies, as well as the various trading platforms and strategies available. This will require researching, understanding market dynamics, and learning about the diverse investment options for both short-term and long-term gains.

As with any form of trading, there are risks and rewards associated with cryptocurrency trading. To minimize these risks, beginners should prioritize security and carefully develop their trading strategies with a focus on long-term sustainability. By thoroughly understanding the basics of cryptocurrency and building a sound trading foundation, beginners will have the best chance at success in the rapidly evolving world of digital asset investment.

Key Takeaways

- Understanding the fundamentals of cryptocurrencies is crucial for beginner traders.

- Developing efficient trading strategies helps in navigating the dynamic landscape of crypto investments.

- Prioritizing security and long-term sustainability is essential to minimize the risks associated with crypto trading.

Understanding Cryptocurrency

Origins of Cryptocurrency

Cryptocurrency is a class of digital assets, including popular ones like Bitcoin and Ethereum. The concept of cryptocurrency emerged in response to the need for a decentralized financial system, where transactions are not controlled by a central authority such as a bank. Bitcoin, created in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto, is considered the first cryptocurrency. Since then, many other cryptos, also known as altcoins, have entered the market.

Blockchain Technology

At the core of all cryptocurrencies lies blockchain technology, which serves as the digital ledger for transactions. Blockchain is a series of decentralized and interconnected blocks that contain data about transactions. Each block represents a group of transactions, and once a block is added to the chain, it cannot be altered. This ensures the integrity and security of the digital currencies.

Cryptocurrencies, such as Bitcoin and Ethereum, are generated through a process called mining. Miners use powerful computers to solve complex mathematical problems that validate and secure transactions. In return, they are rewarded with newly created coins. This process also adds new blocks to the blockchain, maintaining the decentralization and security of cryptocurrencies.

In conclusion, understanding the origins of cryptocurrency and the underlying blockchain technology is crucial for beginners entering the world of trading digital currencies. This knowledge lays the foundation for future learning and helps traders make informed decisions in their financial ventures.

Getting Started with Crypto Trading

Opening a Crypto Exchange Account

To begin trading cryptocurrencies, you’ll need to first open an account with a reputable crypto exchange. A popular option for beginners is Coinbase, which offers a user-friendly interface. Begin by signing up with your email address and creating a secure password.

After registering, you’ll need to complete the verification process by providing identification documents such as a driver’s license or passport. The verification process can take a few hours to several days, depending on the exchange. Once verified, you can link your bank account or credit card to fund your account and start purchasing cryptocurrencies.

Crypto Wallets and Storage

A key aspect of cryptocurrency trading is understanding cryptocurrency wallets for secure storage of your digital assets. There are various types of crypto wallets, including hot wallets (online) and cold wallets (offline). Hot wallets, like those offered by exchanges, provide a convenient method for storing and accessing your cryptocurrencies. However, they may be vulnerable to hacking.

To enhance security, consider using a cold wallet like Ledger, which stores your cryptocurrencies offline and reduces the risk of theft. There are also mobile and desktop wallets that offer a good balance between convenience and security. It’s essential to carefully choose your cryptocurrency storage options and consider using a combination of wallets for optimal safety.

Remember to keep your wallet’s private keys and seed phrases secure, as losing this information can result in the permanent loss of your cryptocurrencies. Regularly update your wallet software to ensure that you’re using the latest security features available.

Types of Cryptocurrency Investments

Investing in Bitcoin

Bitcoin is the first and most well-known cryptocurrency, often referred to as the “digital gold” of the crypto world. Investing in Bitcoin involves purchasing and holding the digital asset in a secure wallet. As the market leader, Bitcoin has a strong track record of price appreciation, making it a popular choice for long-term investors. It is essential to understand the fundamentals and risks associated with Bitcoin before adding it to your investment portfolio.

Investing in Ethereum

Another prominent player in the crypto market is Ethereum, which is not just a digital currency like Bitcoin but also a platform for decentralized applications (dApps) and smart contracts. Investing in Ethereum’s native currency, Ether offers potential for long-term growth and diversification in your cryptocurrency portfolio. Be sure to conduct thorough research on Ethereum’s use cases and development roadmap to make informed decisions.

Exploring Altcoins

Beyond Bitcoin and Ethereum, the cryptocurrency market offers a wide range of alternative digital assets, known as altcoins, that can be part of your investment strategy. Some popular altcoins include Ripple (XRP), Litecoin (LTC), and Chainlink (LINK), each with its unique technology and use cases. Before investing in altcoins, it is crucial to evaluate their potential by examining factors such as the underlying project, team, and historical market performance.

When exploring various investment options, keep in mind that the cryptocurrency market is highly volatile and speculative. It’s essential to manage your risk by diversifying your investments and avoiding emotional decision-making. Always conduct thorough research and maintain a clear, knowledgeable, and neutral approach when analyzing each cryptocurrency’s potential as an investment.

Fundamentals of Crypto Trading

Understanding Trading Pairs

Trading pairs are an essential aspect of cryptocurrency trading. They involve the exchange of one cryptocurrency for another and are often represented using currency symbols, like BTC/ETH (Bitcoin to Ethereum). In crypto trading, investors effectively buy one digital currency while simultaneously selling another. These pairs enable traders to take advantage of the price fluctuations between various cryptocurrencies and help diversify portfolios.

Institutional investors often enter the crypto market by taking positions in major cryptocurrencies, such as Bitcoin and Ethereum. It’s crucial for beginner traders to familiarize themselves with different trading pairs and understand how they impact their investments.

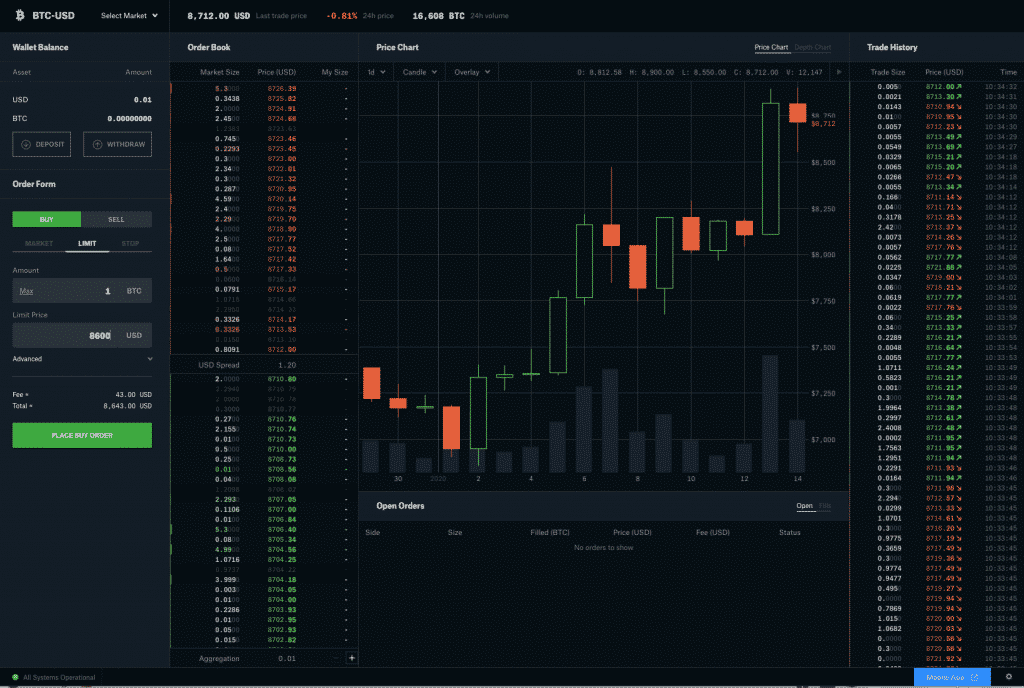

Interpreting Crypto Charts

The ability to read and interpret crypto charts is a crucial skill for successful cryptocurrency trading. Charts display historical price data, allowing traders to identify trends and make informed decisions on when to buy or sell.

- Candlestick charts: These charts are popular among crypto traders as they visually represent price movements within a specified time frame. Each candlestick displays the opening, closing, highest, and lowest price points. Green candlesticks indicate a positive price change, while red ones signify a decrease.

- Volume bars: The trading volume depicts the number of transactions made during a specific time frame. High volume suggests more significant market interest and low volume may indicate a lack of investor activity.

- Moving averages: These are calculated by averaging the closing prices of a cryptocurrency over a set period. Moving averages help traders identify trends by smoothing out price fluctuations.

- Support and resistance levels: These levels represent price points where the market tends to change direction. Support is the price level at which there is significant buying demand and resistance is the level at which selling pressure overcomes buying demand. Identifying these levels helps traders make better entry and exit decisions.

A comprehensive understanding of trading pairs and proficiency in interpreting crypto charts are essential for navigating the cryptocurrency market. By mastering these fundamentals, beginner traders increase their chances of success in the competitive world of crypto trading.

Crypto Trading Strategies

Long Term vs Short Term Trading

In the world of cryptocurrency trading, traders can adopt various strategies based on their investment goals and risk appetite. Long-term trading, often called “HODL” (Hold On for Dear Life), involves buying and holding a cryptocurrency for an extended period, allowing its value to be appreciated over time. This approach is suitable for investors who believe in the long-term potential of a particular coin or token and are ready to withstand short-term price fluctuations.

Short-term trading, on the other hand, involves buying and selling cryptocurrencies within a relatively short timeframe, ranging from hours to weeks. This strategy aims to capitalize on the price volatility common in crypto markets. There are several sub-strategies within short-term trading, such as day trading, swing trading, and scalping, each with its own set of techniques and goals for gaining profits.

Automated vs Manual Trading

Cryptocurrency traders can also choose between manual trading and automated trading. Manual trading requires a hands-on approach, with traders actively monitoring market trends and making decisions based on their analysis. This process can be time-consuming and requires a solid understanding of technical and fundamental analysis techniques. Manual trading is suitable for investors who want to maintain full control over their decisions and are willing to invest the necessary time and effort.

Automated trading, in contrast, relies on algorithms and bots to make trading decisions and execute trades for the investor, following predefined rules and strategies. This method is particularly helpful in managing risk and removing emotional biases from decision-making. Automated trading systems can monitor multiple markets simultaneously, execute trades at high speeds, and adapt to changing market conditions much faster than a human trader could. However, a certain level of technical knowledge is required to set up and maintain these systems effectively.

In conclusion, choosing the appropriate cryptocurrency trading strategy depends on the trader’s investment goals, risk tolerance, and the time they can dedicate to trading. Both long and short term strategies can be executed manually or using automated systems, each with its unique set of benefits and challenges. Being aware of these key distinctions can help beginners make informed choices as they navigate the world of crypto trading.

Risks and Rewards of Crypto Trading

Market Volatility

One of the critical characteristics of the cryptocurrency market is its high volatility. Prices can soar up or plummet quickly, potentially allowing traders to make significant gains. However, this also means that traders may suffer from substantial losses just as quickly. For those new to crypto trading, it is crucial to understand and accept this volatility and to remain flexible – adapting strategies as the market changes.

Risk Management

With high volatility come risks, but with effective risk management strategies, traders can minimize their exposure and optimize potential returns. Some best practices for risk management in crypto trading include:

- Diversification: Don’t put all your eggs in one basket. Spread your investments across different cryptocurrencies and consider investing in other asset classes to distribute the risk.

- Position sizing: Limit the size of individual trades, keeping them small relative to your overall portfolio.

- Stop-loss orders: Utilize stop-loss orders to automatically sell assets when the price falls below a certain predetermined threshold, limiting losses.

- Research and education: To make more informed decisions, stay informed about market trends, technical analysis, and potential risks.

- Long-term perspective: Remember that the crypto market can be highly unpredictable in the short run, but there is potential for long-term growth. Don’t let short-term setbacks discourage you from your trading goals.

By understanding the market’s volatility and implementing sound risk management practices, beginners in cryptocurrency trading can minimize risks and increase their chances of enjoying profitable returns.

Security in Crypto Trading

Security is a crucial aspect in the world of cryptocurrency trading. As a beginner, it is essential to understand the potential risks and take necessary measures to protect your assets from fraud or unauthorized access. The first step to ensuring security in crypto trading is selecting a reputable and secure broker or brokerage platform.

Choosing a reliable broker or brokerage platform is essential in minimizing the risk of fraud. Do thorough research to find a venue with a solid reputation and robust security features like two-factor authentication (2FA) and cold storage for holding your digital assets. These security measures can significantly reduce the chance of unauthorized access to your account and keep your investments safe.

When dealing with cryptocurrencies, it is crucial to maintain strict control over your private keys, the access codes that grant you control over your digital assets. You should never share your private keys with anyone, even a trusted broker. Instead, store them securely in a credible hardware or software wallet.

To further enhance security, consider using a virtual private network (VPN) while trading cryptocurrencies. A VPN can provide an additional layer of protection by encrypting your internet connection and masking your IP address. This makes it more difficult for hackers or malicious actors to monitor your online activity or intercept sensitive information.

In addition to these measures, remain vigilant against phishing attacks and other online scams. Fraudsters may attempt to impersonate your broker or send deceptive emails to trick you into revealing sensitive information. Verify the authenticity of any communication you receive before taking action and immediately report any suspicious activity to your brokerage platform.

Taking these precautions and prioritizing security in your trading activities can reduce the likelihood of falling victim to fraud or other threats. Remember, the responsibility to protect your digital assets ultimately lies with you, so stay informed and be proactive in safeguarding your investments in cryptocurrency trading.

Advanced Crypto Trading Concepts

Trading cryptocurrencies can be complex, particularly when diving into more advanced trading strategies. This section will cover two advanced concepts: Margin and Leverage Trading and Futures and Derivatives Trading.

Margin and Leverage Trading

Margin trading allows traders to borrow funds from a platform to increase their trade size and potentially amplify their profits. It essentially extends their purchasing power, giving them greater exposure to the market. When trading on margin, traders need to maintain a certain amount of collateral in their accounts, known as the margin requirement.

Conversely, leverage is the ratio of borrowed funds to the trader’s collateral. For instance, a 10x leverage means for every $1,000 of collateral, the trader has access to $10,000 for trading. It’s essential to note that while leverage can amplify gains, it can also magnify losses.

Traders should consider their risk tolerance and experience before engaging in margin and leverage trading.

Futures and Derivatives Trading

Futures and derivatives trading are advanced strategies that involve agreements to buy or sell a specified number of tokens or other assets at a predetermined price and future date. These financial instruments can be used to hedge against price fluctuations or exploit potential profit opportunities from changing market conditions.

Futures contracts are standardized and traded on specific exchanges, offering transparency and price discovery. In contrast, derivatives can include several types of contracts, such as options, swaps, and forwards, allowing customization to meet individual needs.

Some key benefits of futures and derivatives trading include:

- Portfolio Diversification: These instruments can expose a broader range of assets and sectors, reducing the risks associated with concentrated positions.

- Risk Management: Traders can use futures and derivatives to hedge their positions against adverse market movements, helping to protect their invested capital.

- Speculation: Traders can use futures and derivatives to bet on specific price movements, potentially earning significant profits if their predictions come true.

However, trading futures and derivatives also entail risks, particularly for inexperienced traders. Before entering such trades, it is crucial to fully understand these instruments’ mechanics and the underlying asset.

Overall, advanced crypto trading concepts like margin and leverage trading and futures and derivatives trading offer sophisticated strategies for experienced and skilled traders. By mastering these techniques, traders can navigate complex market conditions and potentially enhance their returns.

A Beginners Guide Trading Cryptocurrency

Everything You Need to Know to Start Trading Cryptocurrencies Like Bitcoin and Ethereum

We explain how to trade cryptocurrency for beginners. To start trading cryptocurrency you need to choose a cryptocurrency wallet and an exchange to trade on.

From there it is as simple as getting verified with the exchange and funding your account (a process that can take a few days).

Once you are verified and have your account funded, the only thing left to do is to buy or sell crypto using limit, stop, and/or market orders.

In other words, if you want to trade cryptocurrency you need:

- A cryptocurrency wallet (or two). For example, Atomic Wallet, Trezor, or even the wallets offered on exchanges.

- A cryptocurrency exchange (or two) to trade on. For example Coinbase, Bittrex, or Binance.

The next step is trading. When trading, you can:

- Trade dollars to crypto (for example US dollars to Bitcoin or Ripple to US dollars).

- Trade crypto to crypto (for example Bitcoin to Ethereum or Ethereum to Litecoin).

Coinbase, Cash App, and Other Solutions For Trading Cryptocurrency

One solution for all the above is Coinbase/Coinbase Pro.

Coinbase is a good choice because it acts as a wallet, exchange, and place to trade dollars for crypto and crypto to crypto. In other words, Coinbase is an all-in-one solution for everything noted above!

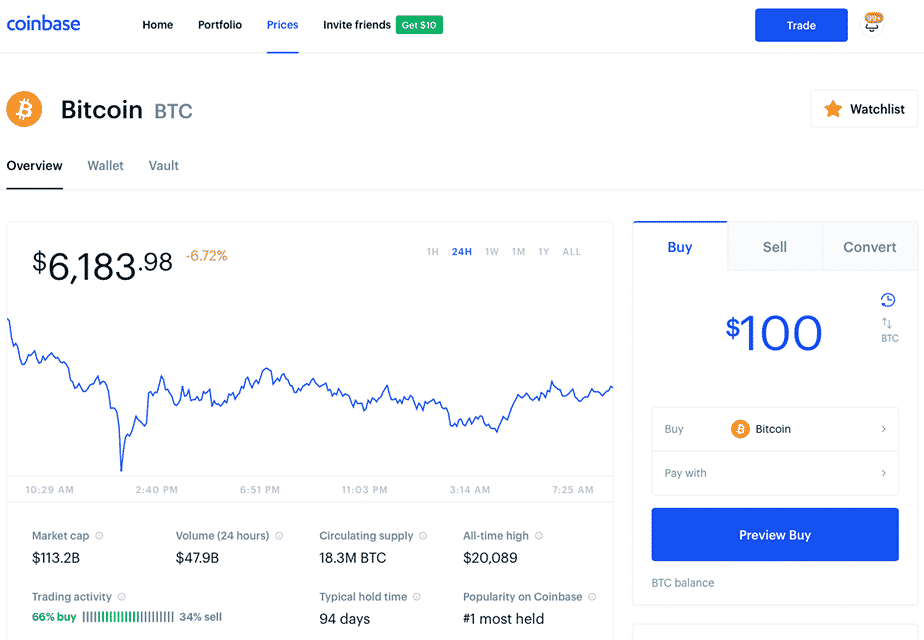

What Coinbase looks like.

With that said, Coinbase has a limited amount of “altcoins” (Bitcoin alternatives like Ethereum, Ripple, and Litecoin), and thus many traders also use popular crypto-to-crypto focused exchanges like Binance, Bittrex, and Kraken to access a wider array of crypto assets.

To get access to a wider range of coins, a trader or investor may use more than one exchange, doing something like buying Bitcoin on Coinbase using USD, and then sending their Bitcoin to Binance to trade Bitcoin for other cryptos (converting back to Bitcoin to sell on Coinbase when they are done).

With the above covered, not every trader / investor is going to want to or be able to deal with cryptocurrencies directly, luckily there are some indirect options as well. These include:

- An app like Square’s Cash App or Robinhood (TIP: For those who don’t want to go the Coinbase route, Square’s Cash App is a particularly good starting point for newcomers who just want to buy/sell Bitcoin and otherwise keep things simple).

- The GBTC trust, ETHE trust, ETCG trust as sold on the stock market (these are solid choices, but watch out for the “premium“).

- A cryptocurrency IRA (these have drawbacks like fees, but they can be valid choices for long term investing).

Now with that said, some traders are going to be familiar with more technical types of trading and/or won’t be US-based. These traders may want to try using leverage, for example on Coinbase Pro or Kraken, or may even consider crypto “derivatives” like futures and options offered by platforms like Bakkt, CME, FTX, or BitMEX. Leverage and derivatives aren’t beginner-friendly, but for seasoned traders new to crypto, they can make sense.

Each option has its pros and cons, but notably, only an exchange-broker-wallet hybrid like Coinbase/Coinbase Pro allows one to trade, invest, store, send, and receive coins directly using a single platform.

Given the above, this page will focus on getting you started with Coinbase due to its ease of use for beginners and due to its usefulness for advanced users too.

Our Suggestion: Use Cash App if you want to keep things simple and just buy Bitcoin, use Coinbase if you are ready for real cryptocurrency investing and trading, and then when you have mastered Coinbase move onto Coinbase Pro, Binance, and Bittrex to get a wider selection of crypto assets. If at some point you feel like you have mastered trading and risk management strategies, then you may want to consider leverage and derivatives trading. Trying to do this out of order can lead to real issues, so we strongly suggest learning to walk before you run here. Lastly, at any point in this process, we suggest getting a hardware wallet like Trezor and storing your long term holdings in your own wallet. Also, once you learn the ropes, educating yourself on other aspects of crypto like mining and how blockchain and smart contracts work is a good idea too!

How to Pick the Right Exchange

Above we laid out some choices for where to trade, below we will dive a little deeper into those choices to help you pick the right crypto exchange for you.

The first thing to understand is that you don’t have to jump right into traditional crypto exchange trading to get exposure to crypto. In fact:

- A beginner might prefer to use the Square Cash App or Robinhood. Square’s Cash App is an excellent choice for newcomers. Cash App lets you buy/sell/send/receive/store Bitcoin just like Coinbase. Cash App doesn’t offer all the other crypto choices Coinbase does, but it does provide a simple way to get exposure to Bitcoin without having to fully learn too much about crypto wallets and exchanges. Meanwhile, Robinhood is another solution that isn’t a full-fledged exchange. While they aren’t offered in all states and unlike Cash App don’t allow deposits and withdrawals, they do offer a larger selection of coins than Cash App and plan to allow transfers in the future.

- A beginner might prefer to trade cryptocurrency stocks on the stock market. For example, GBTC is a trust that owns Bitcoin and sells shares of it. Trading GBTC avoids you having to trade cryptocurrency directly, but still allows you exposure to Bitcoin. Beyond GBTC (and the Ethereum ETHE and Ethereum Classic version ETCG), your options are very limited for crypto stocks. Be aware that GBTC often trades at a premium (meaning bitcoins are cheaper than buying shares of the GBTC trust), which isn’t ideal. Also, cryptocurrency trading is a 24-hour market, where the traditional stock market is not. Learn more about the GBTC Bitcoin Trust and the related pros and cons before you invest.

GBTC’s price to NAV can get a little absurd at times.

For those who want the real cryptocurrency experience, the questions become 1. do you want to deal with limit orders and real exchange trading, and 2. do you want a wide selection of coins?

I think the simplest and best place to buy, sell, and store coins in the US is Coinbase (and our tutorial below will help you get set up with that), but you can only buy, sell, and store Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and a small (but growing) selection of other coins on Coinbase. Coinbase will let you try out simple broker based trading and real exchange-based trading and will give you exposure to enough coins to get you started.

However, if you are serious about trading cryptocurrency, and want access to all the coins crypto has to offer, you’ll want to also sign up for another platform that allows you to buy/sell crypto like Coinbase Wallet, Bittrex, Binance, or Kraken (and may want to find other solutions for wallets to store your coins in like TREZOR).

See our list of exchanges for beginners for a more complete list of options.

TIP: Even if you are going to get fancy with wallets and exchanges, Coinbase is a good starting point because it works as a simple on-ramp / off-ramp for fiat (i.e. you can easily trade dollars for cryptos on Coinbase, and this is not true of most exchanges).

Why Pick Coinbase As Your First Exchange?

As you can tell already, even though we have presented a range of choices, this guide is suggesting that Coinbase is a good starting place. That is because in general when picking a first exchange the following is true:

- A beginner should start by choosing a company with a good reputation that offers an exchange and wallet (to help keep the process simple).

- A beginner should also start by trading prominent coins. Currently, in 2020, we are referring to coins like Bitcoin (BTC) and Ethereum (ETH). In the future, this could change.

Since the above is the case, a good start for anyone wishing to trade cryptocurrency is starting with Coinbase.com (the most popular cryptocurrency website in the United States, and a service that offers a single platform for a Bitcoin wallet, Ethereum wallet, Litecoin wallet, Bitcoin Cash wallet, etc and a currency exchange).

After you master Coinbase, then you are ready for say Coinbase Pro and other exchanges like Bittrex, Binance, or Kraken. After that, you might want to check out derivatives trading if your region allows it and you really have some trading chops. For now though, let’s learn to walk before we run and get Coinbase set up. The next section will walk you through setting up Coinbase.

TIP: A good first foray into cryptocurrency investing is the obvious, buying a major cryptocurrency like Bitcoin. After that, you’ll probably want to trade USD for crypto on an exchange like Coinbase Pro. Once you have done that, you could try trading BTC and ETH for other cryptocurrencies. Trading “crypto pairs” can be rewarding, but it is more complex and often more risky than just buying a single cryptocurrency as an investment. In other words, start by trading dollars for major coins like BTC and ETH on an exchange like Coinbase, and then when you are ready try trading BTC and ETH for other coins on an exchange like Binance or Coinbase Pro.

Related Post:

- 5 Ways Gig Economy Workers Can Save for Retirement

- 7 Tips for Saving for Retirement if You Started Late: A Comprehensive Guide

- 4 things you MUST know when retirement investing

- How to start trading?

- Bitcoin Market Cycles and You

© 2020 Tradewins Publishing. All rights reserved. | Privacy Policy | Terms and Conditions | Contact Us

The information provided by the newsletters, trading, training and educational products related to various markets (collectively referred to as the “Services”) is not customized or personalized to any particular risk profile or tolerance. Nor is the information published by Legacy Publishing, LLC (“Legacy”) a customized or personalized recommendation to buy, sell, hold, or invest in particular financial products. Past performance is not necessarily indicative of future results. Trading and investing involve substantial risk and is not appropriate for everyone. The actual profit results presented here may vary with the actual profit results presented in other Legacy Publishing LLC publications due to the different strategies and time frames presented in other publications. Trading on margin carries a high level of risk, and may not be suitable for all investors. Other than the refund policy detailed elsewhere, Legacy does not make any guarantee or other promise as to any results that may be obtained from using the Services. Legacy disclaims any and all liability for any investment or trading loss sustained by a subscriber. You should trade or invest only “risk capital” – money you can afford to lose. Trading stocks and stock options involves high risk and you can lose the entire principal amount invested or more. There is no guarantee that systems, indicators, or trading signals will result in profits or that they will not produce losses.

Some profit examples are based on hypothetical or simulated trading. This means the trades are not actual trades and instead are hypothetical trades based on real market prices at the time the recommendation is disseminated. No actual money is invested, nor are any trades executed. Hypothetical or simulated performance is not necessarily indicative of future results. Hypothetical performance results have many inherent limitations, some of which are described below. Also, the hypothetical results do not include the costs of subscriptions, commissions, or other fees. Because the trades underlying these examples have not actually been executed, the results may understate or overstate the impact of certain market factors, such as lack of liquidity. Legacy makes no representations or warranties that any account will or is likely to achieve profits similar to those shown. No representation is being made that you will achieve profits or the same results as any person providing a testimonial. Testimonials relate to various other products offered by Legacy Publishing and not the product offered here, but all of these products are based on Chuck Hughes’ system. Performance results of other products described in such testimonials may be materially different from results for the product being offered and may have been achieved before the product being offered was developed.

Results described in testimonials from other products or the product being offered may not be typical or representative of results achieved by other users of such products. No representation is being made that any of the persons who provide testimonials have continued to experience the same level of profitable trading after the date on which the testimonial was provided. In fact, such persons may have experienced losses immediately thereafter or may have experienced losses preceding the period of time referenced in the testimonial. No representation is being made that you will achieve profits or the same results as any person providing a testimonial. The cost basis for some of the options in a portfolio may be reduced by rolling over profits at option expiration which is one of the Hughes Optioneering Trade Management Rules. Some income figures presented represent the total amount of option premium collected during the referenced period. Actual profits were less. Open trade profit results may have increased or decreased when the trades were closed out. Chuck Hughes‘ experiences are not typical. Chuck Hughes is an experienced investor and your results will vary depending on risk tolerance, amount of risk capital utilized, size of trading position, willingness to follow the rules and other factors.